We need to declutter and archive statements more often.

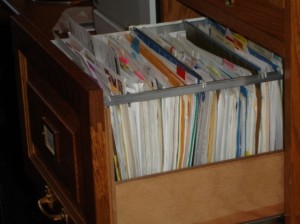

The truth is my husband and I archive our records once every three years. Thirty-six months of accumulated paperwork is all our file cabinets can handle.

By this time, our files have grown so full that even the hanging folders lose their grip and collapse from the weight of being overstuffed.

It’s also about this time that my husband and I hate filing papers. It becomes a chore to try to stuff one more balanced credit union statement, one more receipt, one more paid utility bill, one more… In years past, we’d start a pile in front of the file cabinet. But we learned painful lessons over the years when having to file all that accumulated paperwork.

Late last year, my husband, David, removed all the pre-2014 paperwork and stacked all those sheets of paper into a neat pile on a shelf.

Time to Archive

It was exactly three years and one month this past weekend, when we pulled out the banker’s boxes and plastic storage bins in order to archive this paperwork among our older records.

Eeeeewwwwww. There was even a dated note on one of the bins: 12/18/2011 This bin is full.

We need to let go of our older records.

As a STUFFologist, the thought of buying a new bin did not occur to me. Instead, using Nature’s process as noted in “Input Throughput Output,” Chapter 21 in Part Four of (click on) STUFFology 101, we needed to let go of some stuff.

It took the better part of a quarter hour to decide what we would let go and then the better part of three hours to get the job done.

We keep records of the last seven years. Anything prior to that, we reviewed and reduced to make room for the newer records.

It’s a slow process at best because it’s not simply a matter of tossing records from 2006 and earlier. You may recall I have a need to look through my paperwork one more time before letting go. So, the process will take a bit longer.

For one thing, I purchased a few stocks over a decade ago that I still own. I need to look through my paperwork to see if I still have those records. It would be much harder to get them from the brokerage as I’ve changed brokers over the years, too. I’ll need this information to calculate the long-term capital gain when I’m ready to sell.

This is the process of dealing with (click on) S.T.U.F.F.—we need to Start, Trust the process, Understand that it will take time, and Focus, in order to Finish.

David and I decided that we need to archive and de-clutter statements more often.

In one and a half weeks, we’ve set aside time to return to this process of removing our older records. This time, it should be easier since we’re not waiting three years to review and be reacquainted with our filing system. Over time, I have faith that the process will move faster as we feel strengthened by saving only what we need.

How about you? What area do you define as clutter and how can you get started with decluttering your STUFF?

Avadian photo 2021 NAPA Wine Country Castello di Amorosa in Calistoga

Avadian photo 2021 NAPA Wine Country Castello di Amorosa in Calistoga

Thanks for sharing this experience Brenda. It is important for both individuals and businesses to keep track of their records for tax purposes. Tedious but necessary.

Looking at each piece of paper during the process is important too, because you never know what will turn up. My Mom has been sick for a few years now and suffering from some memory issues as a result. While going through older financial records my Dad discovered some Lucent Technology stock information in a drawer. He got a nice cash return on his time spent.

So don’t throw those financial records out without looking closely at them first!

WOW, that unexpected gift of company stock information is a powerful incentive, Eric.

Same as what I wrote in “The U.S. Savings Bonds Windfall” — chapter 24 of STUFFology 101.

We never know what we’ll find.